The total crypto market cap (TOTAL) noted a slight dip over the last 24 hours with Bitcoin (BTC) holding above $110,000. However, some altcoins managed to surprise the market by taking a different route posting gains, led by Memecore’s (M) near 40% rise.

In the news today:-

Sponsored- Fireblocks launched its Network for Payments to enable stablecoin transactions across 100+ countries, offering compliance, liquidity, and scalability. The platform allows fintechs, PSPs, and institutions to build products for remittances, payouts, settlements, and cross-border treasury management.

- Monex Group, parent of Coincheck, expanded its stake in Canadian digital asset manager 3iQ Digital Holdings to near full control. The move strengthens its position in crypto investment as institutional demand grows.

The Crypto Market Needs To Find Stability

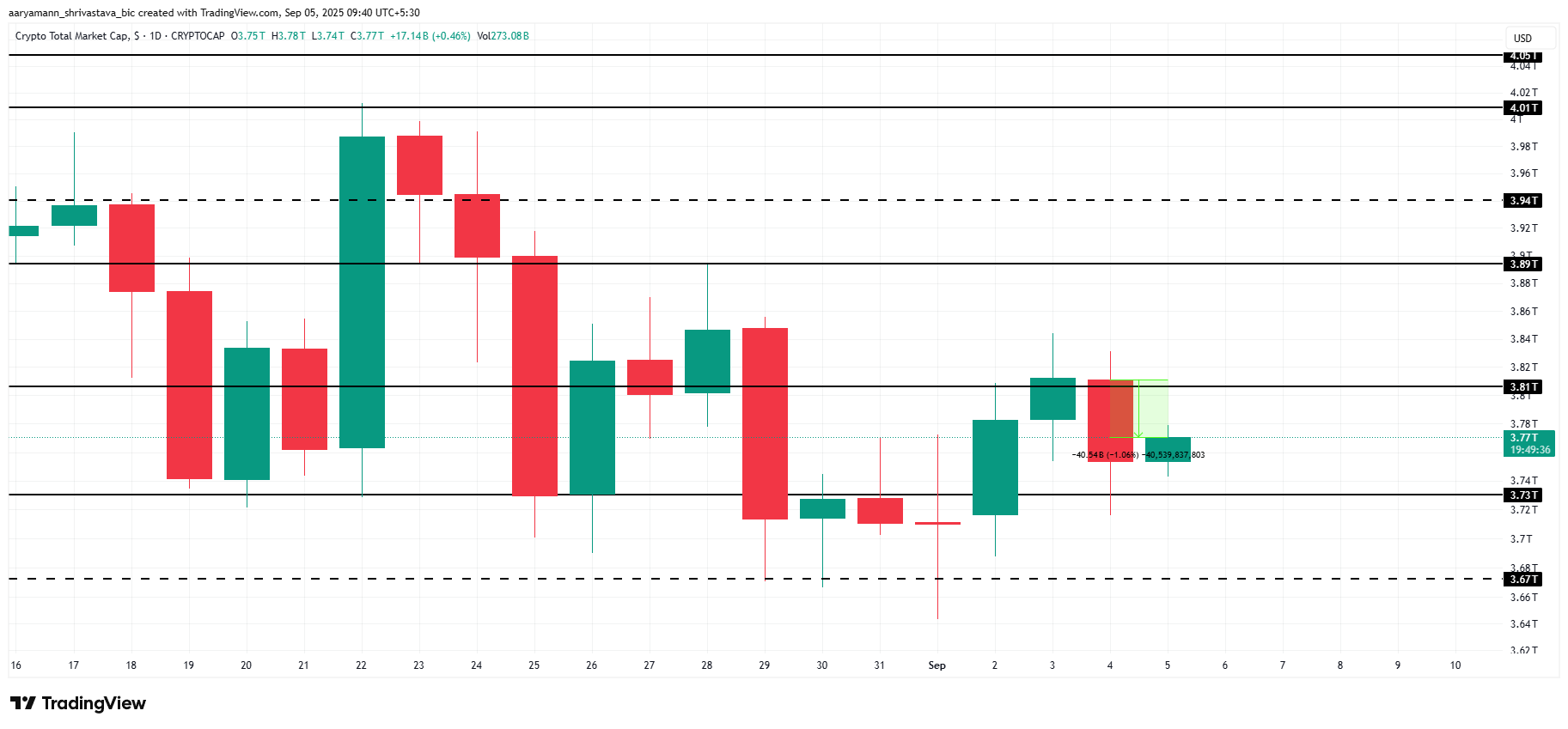

The total crypto market cap has fallen by $40 billion in the past 24 hours, standing at $3.77 trillion. TOTAL was unable to secure $3.81 trillion as support, highlighting ongoing selling pressure.

Currently, TOTAL is holding above $3.73 trillion support, showing resilience despite the recent drop. The likelihood of falling below this level appears limited for now. Instead, the crypto market may consolidate in the short term.

Sponsored SponsoredFor token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If market conditions improve, TOTAL could initiate a recovery. Reclaiming $3.81 trillion as support would mark a critical step in restoring bullish momentum. With renewed strength, the total crypto market cap may attempt a move toward $3.89 trillion, providing relief for investors after the recent losses.

Bitcoin Is Holding Above Support

Bitcoin is trading at $111,260, maintaining support above $110,000 despite recent fluctuations. The crypto king remains capped under the $112,500 resistance level, keeping price action rangebound.

The Relative Strength Index remains below the neutral 50.0 mark, signaling persistent bearish pressure. This indicates that Bitcoin’s recovery attempts may face challenges in the near term. However, a sharp drop below $110,000 is unlikely, suggesting that BTC may continue to stabilize within its current trading range.

If Bitcoin successfully breaches $112,500, momentum could shift in favor of buyers. Flipping this level into support would strengthen the bullish outlook and potentially drive BTC toward $115,000.

Memecore Is A Leader

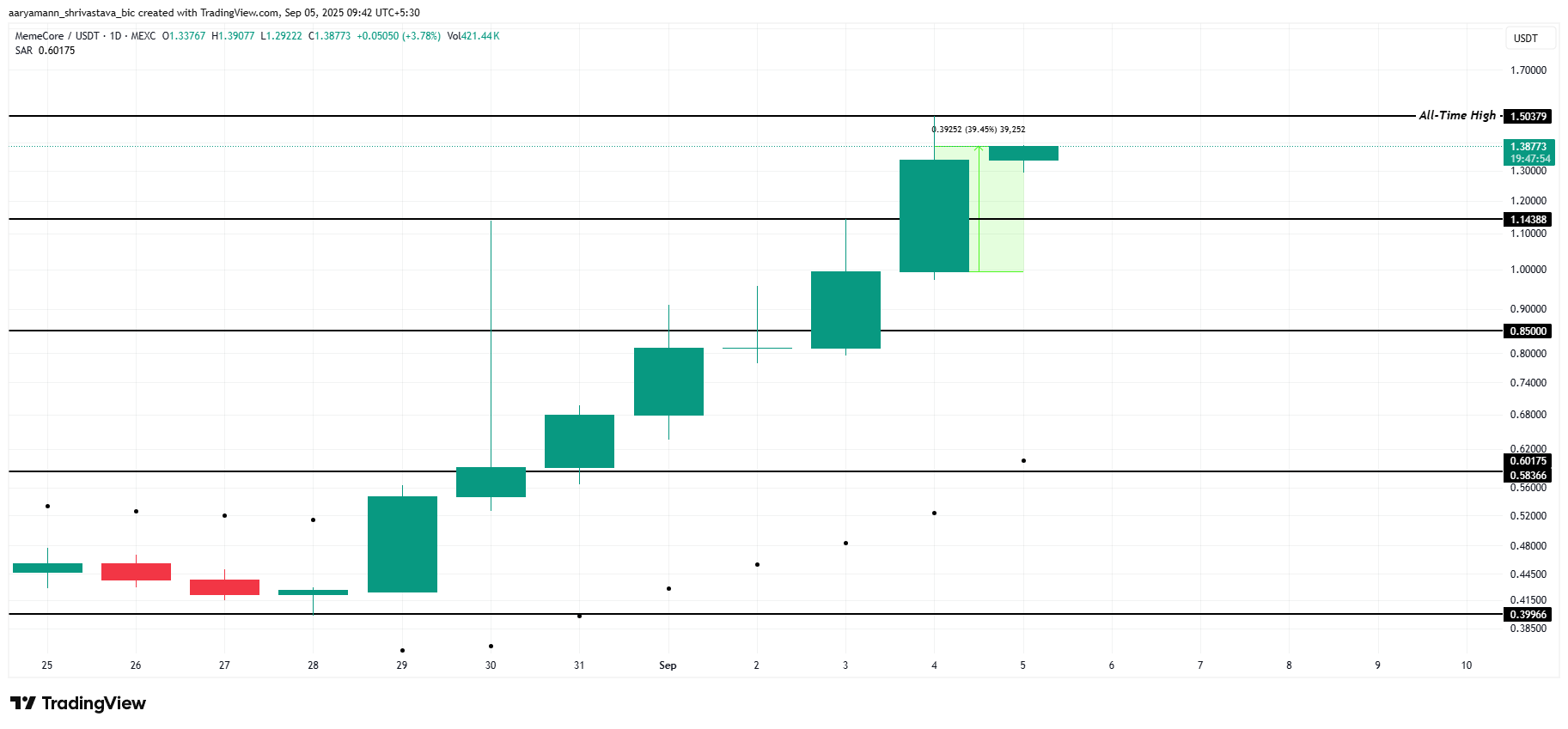

M price surged nearly 40% in the past 24 hours, trading at $1.38 at the time of writing. The altcoin also set a new all-time high of $1.50 during this rally. This highlights strong investor demand and renewed confidence in its short-term momentum despite broader market volatility.

The Parabolic SAR currently signals an active uptrend, suggesting M could continue its climb. If momentum holds, the altcoin may push higher toward the $1.70 resistance level. Breaching this point would reinforce bullish sentiment and extend the rally, potentially establishing new highs in the days ahead.

If profit-taking emerges, M could face significant downside pressure. A sharp sell-off might send the altcoin below its $1.14 support level. Such a move would erase recent gains, weaken market confidence, and invalidate the current bullish thesis.