Tiger Research forecasts that Bitcoin prices could surge to $190,000 in Q3 2025, representing a potential 67% upside driven by accelerating institutional inflows, record-breaking global liquidity, and the opening of the US 401(k) retirement channel.

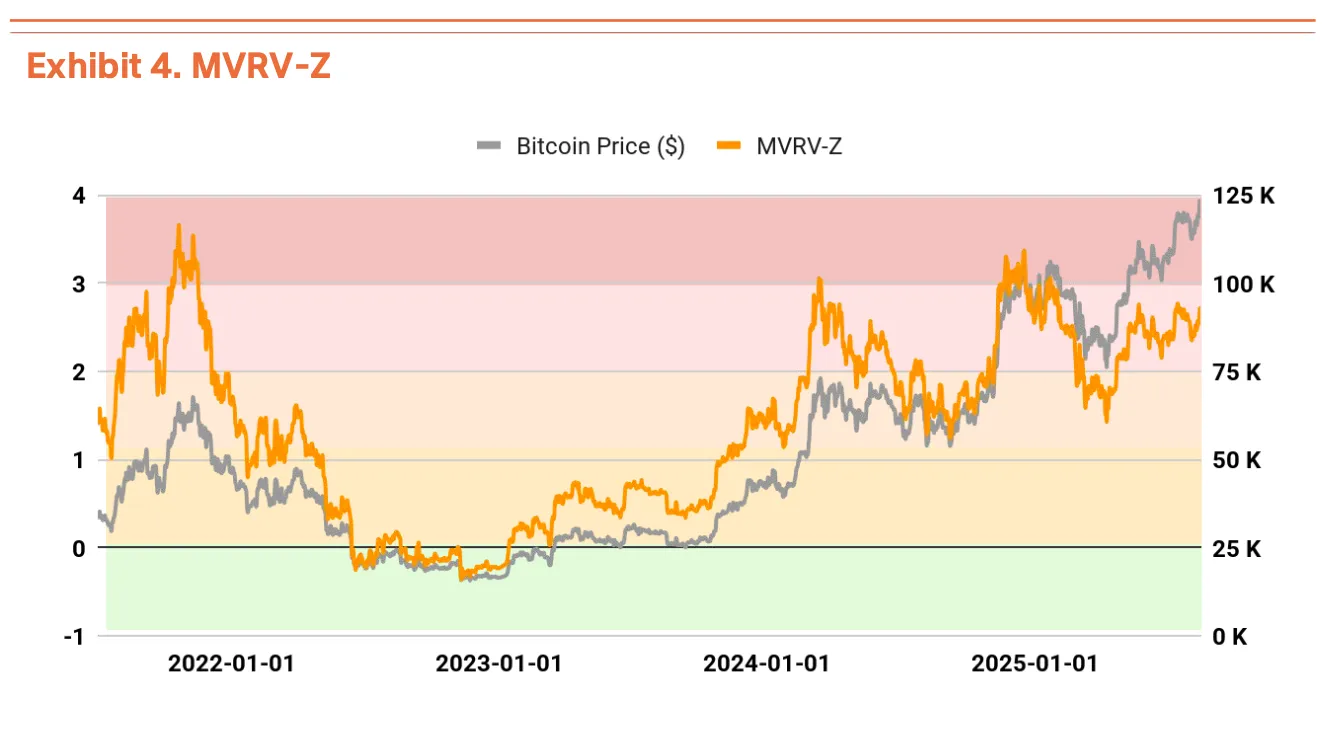

Yet, the market still carries the risk of short-term corrections, as on-chain indicators flash signs of overheating, reminding investors to remain cautious.

SponsoredKey Drivers Behind the Bitcoin Q3 2025 Outlook

In its latest valuation report, Tiger Research projects that Bitcoin could reach $190,000 in Q3 2025 — about 67% higher than today.

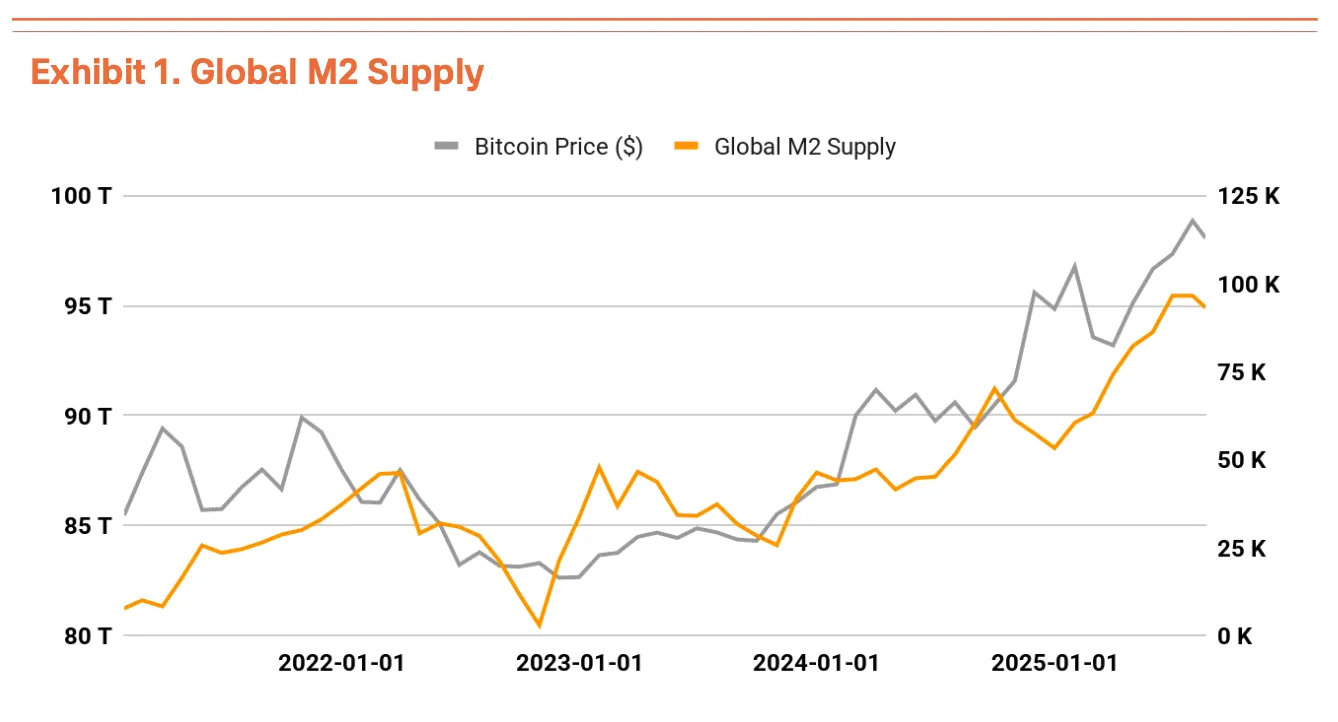

The report identifies three major catalysts fueling this bullish outlook: the rapid expansion of institutional capital, unprecedented global liquidity, and adding Bitcoin investment options in US 401(k) retirement accounts.

Sponsored SponsoredAll these mark a structural shift, with the Bitcoin market becoming increasingly institution-driven rather than retail-led. Tiger Research underlined, “This dynamic is supported by institutional buying power outstripping retail buying.”

In particular, the 401(k) channel is seen as a game-changing catalyst. With the immense size of US retirement funds, even a modest allocation into Bitcoin could unleash substantial long-term demand.

Tiger Research’s valuation is based on the TVM (Time Value of Money) model, enhanced by on-chain metrics and macroeconomic conditions. The report noted, “Our model suggests a fair value of $190,000 by Q3 if current liquidity and adoption trends persist.”

Risks and Short-Term Corrections

Tiger Research also warns of potential short-term correction despite the strong growth outlook. BeInCrypto reported that Bitcoin’s price is heading towards the $100,000–$107,000 support zone amid heavy liquidation.

SponsoredMetrics like MVRV-Z are approaching overbought zones, hinting at possible pullbacks before Bitcoin continues its climb. Based on the MVRV-Z indicator, an X user said, “We’re not even close to the danger zone yet. People aren’t massively overextended on profits like they were at previous tops. This tells me we’ve got room to run.”

In addition, Bitcoin’s trajectory remains tied to global macroeconomic conditions. Interest rate policies, geopolitical uncertainties, and liquidity shifts can impact its price path.

The Bitcoin Q3 2025 forecast from Tiger Research highlights a highly optimistic scenario, with the potential for the world’s largest cryptocurrency to reach $190,000.

At the same time, the report reminds investors of the importance of risk management amid market volatility. Ultimately, whether Bitcoin achieves this milestone will depend on the interplay of institutional capital inflows, global liquidity, and unpredictable macroeconomic variables.