Bitcoin’s price has steadily risen, climbing approximately 4% over the past seven days. This trend reflects improving market sentiment and growing optimism among investors.

As momentum builds, key on-chain indicators signal the possibility of a sustained rally in the coming trading sessions.

SponsoredBitcoin Miners Hold Tight

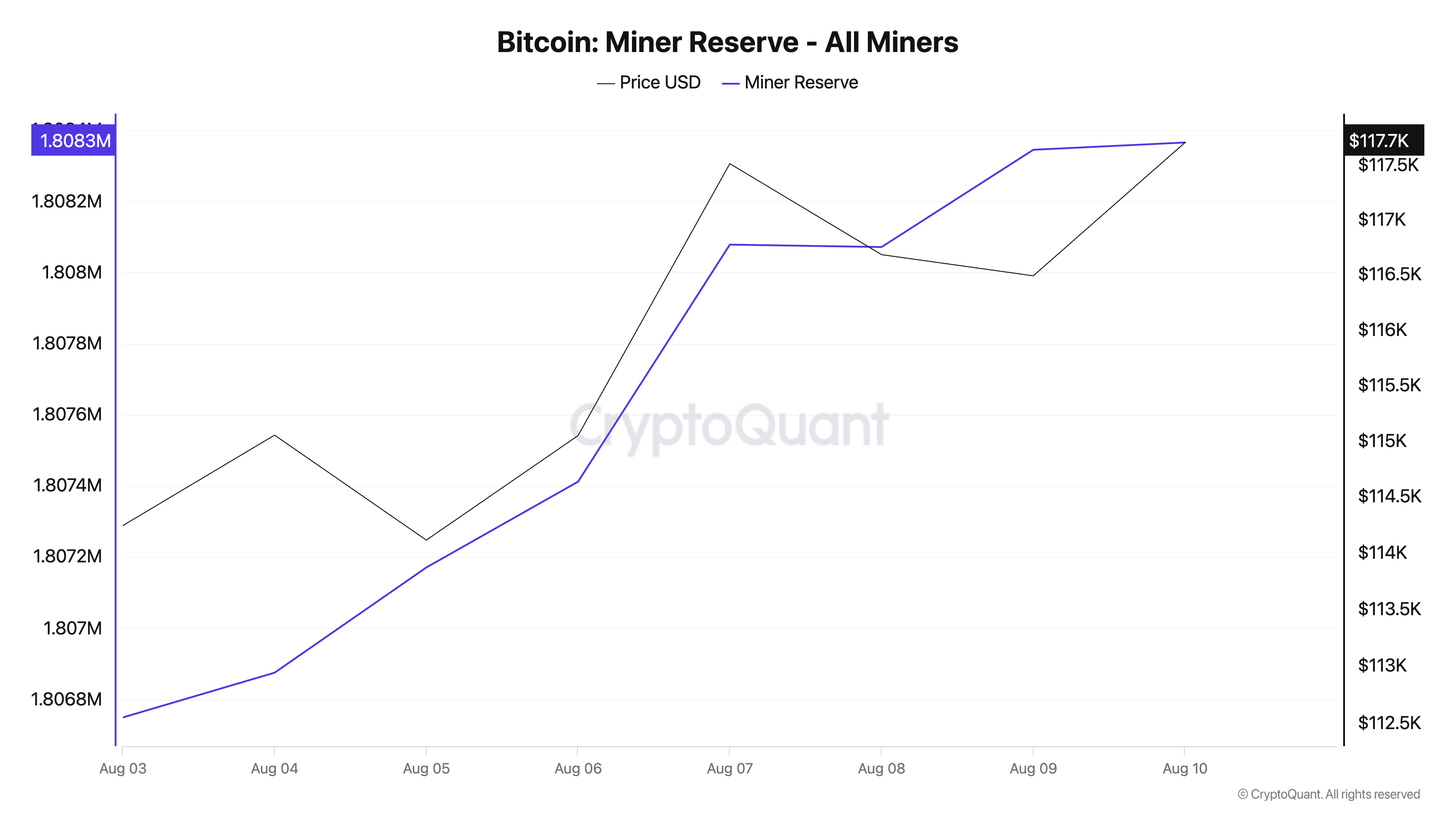

Bitcoin miners have resumed accumulation, with the coin’s miner reserve reaching a weekly high of 1.8 million BTC.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Bitcoin miner reserve tracks the number of coins held in miners’ wallets. It represents the coin reserves miners have yet to sell. When it declines, miners are moving coins out of their wallets, usually to sell, confirming growing bearish sentiment against BTC.

Converesly, when it climbs, miners are holding onto more of their mined coins, which usually reflects confidence in future price appreciation and a bullish outlook.

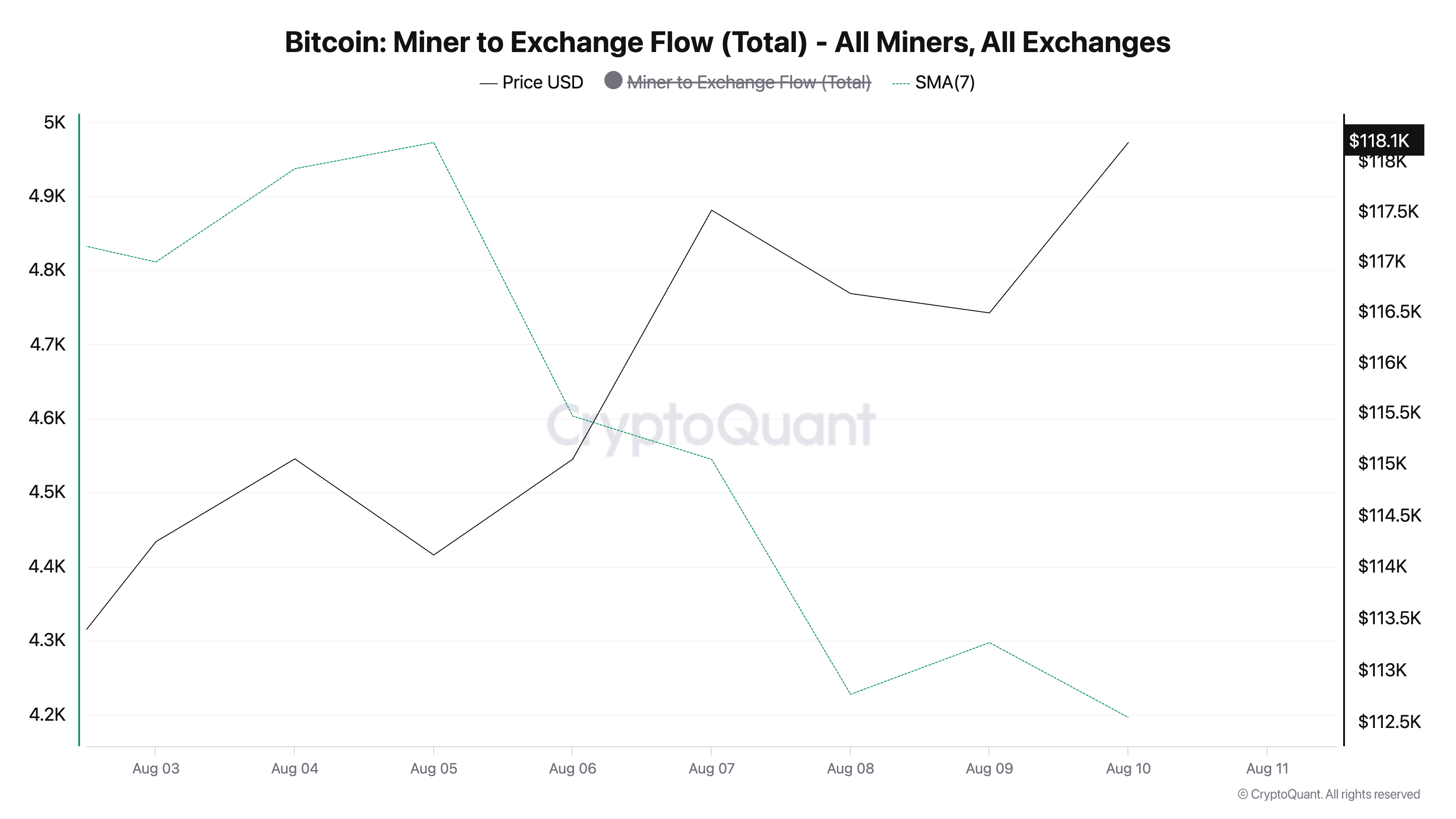

Furthermore, the decline in BTC’s Miner-to-Exchange Flow highlights the accumulation trend among miners on the network over the past seven days.

According to CryptoQuant, this metric, which measures the total amount of coins sent from miner wallets to exchanges, has plunged by 10% during that period.

When BTC’s Miner-to-Exchange Flow falls, miners hold back from selling and keep their coins off exchanges. This reduced selling pressure signals growing confidence in BTC’s price and can help strengthen its rally.

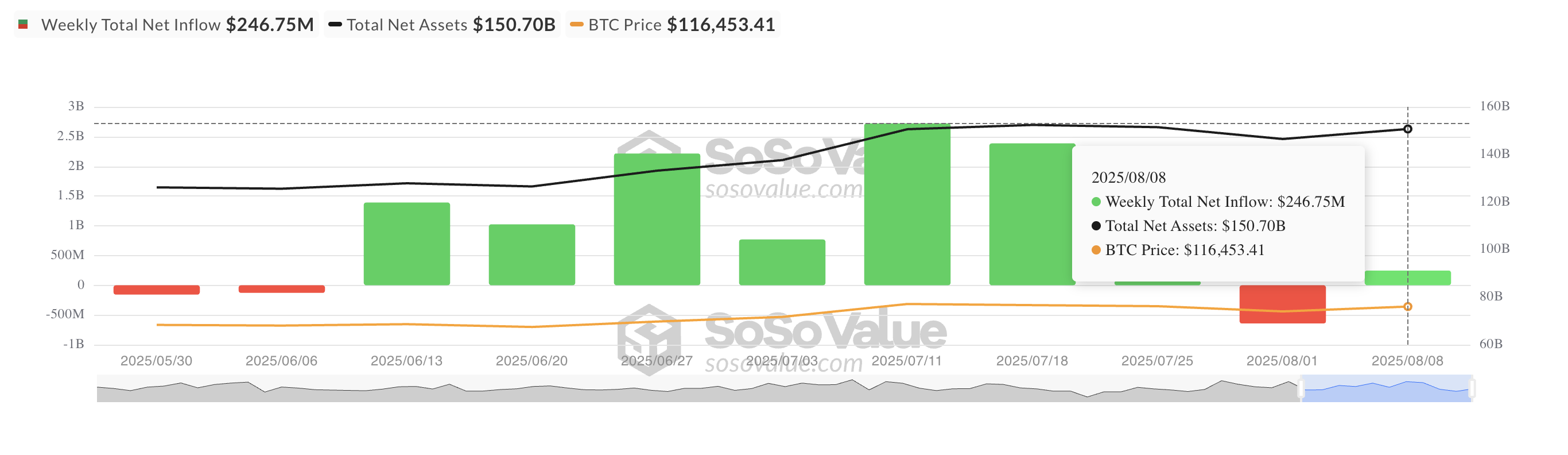

Moreover, last week, weekly inflows into spot Bitcoin ETFs turned positive, reversing the negative outflows recorded in the previous week. Per SosoValue, between August 4 and 8, capital inflow into these funds totaled $247 million.

Sponsored

This shift signals renewed institutional buying interest and a change in market bias toward BTC. Institutional investors remain confident that the coin will extend its gains and are increasing their direct exposure through ETFs.

Can BTC Push Past $118,851 to $120,000?

This combination of renewed institutional demand and miner confidence strengthens the case for BTC’s near-term return to above $120,000. However, for this to happen, the king coin must first break above the resistance at $118,851.

On the other hand, if accumulation stalls, the coin could resume its decline and fall toward $115,892.